Non-issuance of VAT invoice is a criminal act – GRA

The Ghana Revenue Authority (GRA), compliance and enforcement unit, says the non-issuance of Valued Added Tax (VAT) invoice is a criminal offence and can lead to prosecution. The Authority said tax defaulters could be charged under sections 78 and 82 of the Revenue Administration Act, 2016 (Act 915) that focus on failure to comply with […]

GRA’s implementation of 10% withholding tax on betting, lottery winnings begins August 15

The Ghana Revenue Authority (GRA) has announced that it will begin implementing a 10% withholding tax on all gross gaming winnings from August 15, 2023. The GRA explained that the withholding tax will be charged on profits accrued after each win and that the existing 15% Value Added Tax (VAT) rate on each stake will […]

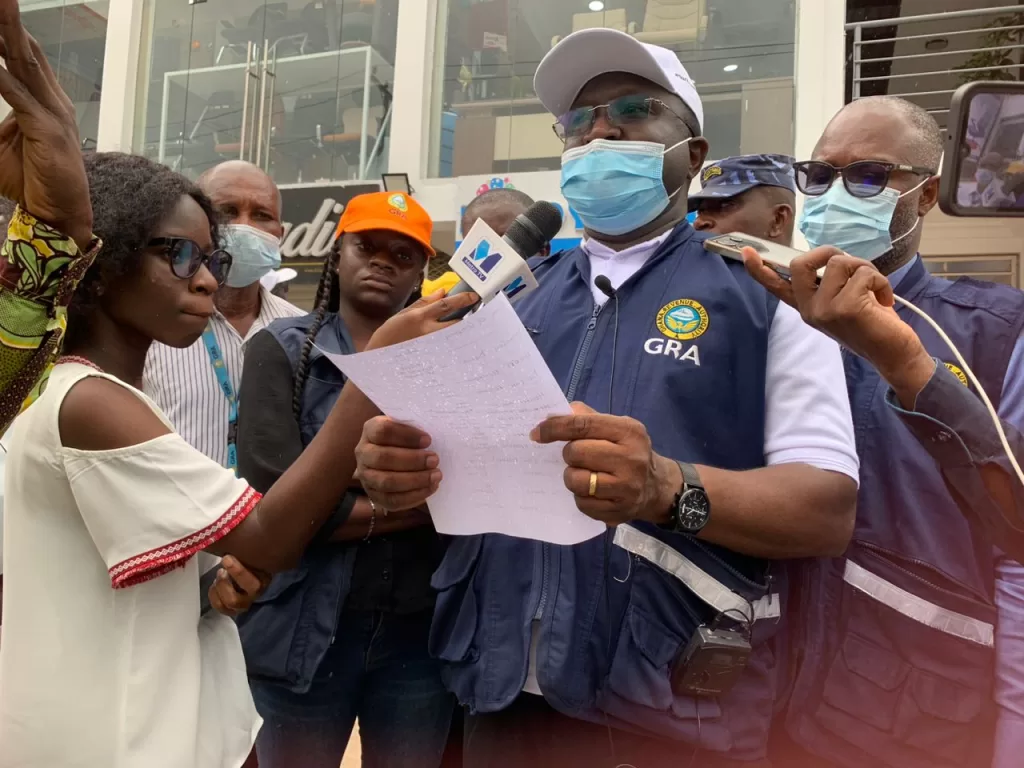

GRA taskforce arrests managers of enterprises for tax infractions

The Ghana Revenue Authority (GRA) taskforce has arrested four managers of enterprises in Accra for not issuing tax invoices. The companies are Buildmart Company Ghana in Adabraka, Bedarts Cold Supplies in Lashibi, Yat Ventures in Mamobi and Excellence Boutique at Spintex Road. The managers were taken to the Customs Office at the headquarters for their […]

GRA’s 12.5% VAT upfront payment for non-registered VAT importers begins June 6

By: Franklin ASARE-DONKOH The Ghana Revenue Authority (GRA) will from Tuesday, June 6, 2023, impose an upfront payment of 12.5 percent (12.5%) tax on the value of goods imported by persons or companies who are yet to register for Value Added Tax (VAT) with the Authority. According to the management of GRA, importers of taxable […]