By Ashiadey Dotse

The Attorney-General, Dr Dominic Ayine Akuritingah, has announced the conclusion of investigations into an alleged fraud involving the founder and leader of the Liberal Party of Ghana (LPG), Percival Kofi Akpaloo, revealing that COCOBOD cheques totalling GH¢3,169,432.22 were diverted and never paid to the legitimate contractor.

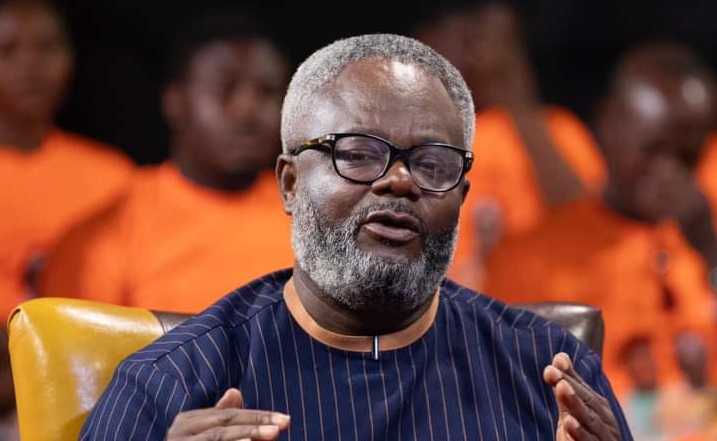

Speaking during the Government Accountability Series at the Presidency on Monday, December 22, 2025, Dr Ayine said the case began after the Financial Intelligence Centre (FIC) filed a suspicious transaction report with FirstBank Ghana Limited over unusual transactions on an account linked to a company associated with Mr Akpaloo. This subsequently triggered investigations by the Economic and Organised Crime Office (EOCO).

According to the Attorney-General, investigations established that a legitimate company, Pomaa Universal Ghana Limited, wholly owned by businesswoman Akua Pomaa, was awarded a GH¢29.5 million COCOBOD contract in December 2020. While initial payments for the project were correctly made to the company, subsequent payments raised serious concerns.

Dr Ayine disclosed that Mr Akpaloo allegedly secretly incorporated another company with a nearly identical name, differing only by the addition of the letter “h”, and used it to divert funds intended for the original contractor.

He explained that between December 2022 and June 2024, Mr Akpaloo allegedly collected eight cheques issued by COCOBOD in the name of Pomaa Universal Ghana Limited and deposited them into the account of the look-alike company at FirstBank Ghana Limited.

Investigations further revealed that Akua Pomaa was unaware of both the existence of the second company and the diversion of funds until COCOBOD contacted her in June 2024 regarding outstanding balances on the contract. She later alleged that Mr Akpaloo forged her signature on the COCOBOD contract, using her former name, Mercy Owusu, without her consent.

Dr Ayine said FirstBank Ghana Limited conducted its own internal investigations, which corroborated the fraud allegations, and admitted operational failures in detecting discrepancies between cheque payee names and the accounts into which the cheques were deposited.

The suspects named in the case include Percival Kofi Akpaloo, the look-alike company, and his spouse. The Attorney-General said the evidence points to offences including stealing, forgery and money laundering, adding that charges will be filed by his office upon the resumption of work.